Errors & Omissions (E&O) for Vineyard / Farm / Agriculture

Errors and Omissions (E&O) Coverage Specifically Designed For Vineyard, Farm, Agriculture, and Associated Classes

Coverage provided by certain underwriters at Lloyd’s

Is Your Client's Company At Risk?

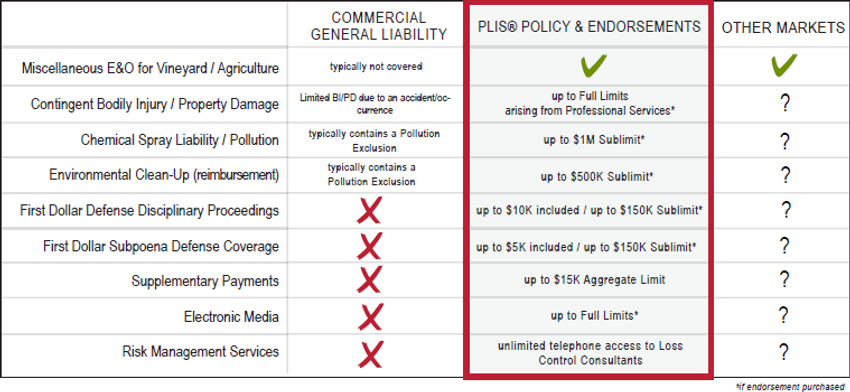

An individual or an entity providing professional services to others for a fee has an exposure. Professionals are held to a higher standard that can be dictated by their industry. A claim, even if groundless, can generate substantial costs which could jeopardize the financial stability of your client. In the increasing litigious environment, is your client in a position to absorb this cost? The risk can be transferred to a Miscellaneous Errors and Omissions policy customized for these type of classes.

Be aware, professional services are typically excluded by General Liability policies.

Vineyards and Farms need Errors & Omissions (E&O) coverage. At some point in a company's lifespan, a mistake will happen... a liability will occur... and a customer will sue. Don't be misled that a GL policy will pick up a negligent act, error, omission. That's why your clients need an E&O policy.

What is Vineyard & Farm E&O?

Vineyard and Farm Errors and Omissions is a liability policy to protect individuals or entities from claims of negligence or failing to perform professional services to others for a fee. This product was developed to address third party vineyard and managers, operators or consultants, including associated classes. These individuals or entities have different needs depending on the the industry, the professional services rendered, their specialty, etc. There are a variety of additional coverage options via endorsements that can customize a policy for your client.

Vineyard & Farm Professional Classes:

- Agrilabs

- Food Grade Chemical Applicator (100%)

- Event Planner

- Farm Labor Contractor

- Farm Management Consultant

- Farm Manager/Operator

- Food Service/Safety

- Consultant Forestry Consultant

- Irrigation Consultant

- Landscape Design

- Photographer

- Tree Surgeon

- Tour Guide

- Videographer

- Vineyard Consultant

- Vineyard Manager/Operator

- Winemakers (& Blenders)

Loss Control Consultants – Specialty Risk Management® , Inc. (SRM®).

SRM’s Loss Control Consultants are available to Insureds throughout the policy period to help mitigate and control exposures and events. We work with you to identify exposures and potential ways to avoid or minimize issues, lessening the impact to your business. We are a resource in the areas of loss control, customer complaints, professional and contractual standards, risk management and others.

SRM has consistently provided a combination of services to our client base in a wide range of industries since 1998 through our Loss Control Consulting Service. SRM is staffed with experienced professionals who are licensed in the field of Loss Control and Risk Management at the State and National level.

Experience working with a variety of government agencies (FDA, EPA, State & Local Pollution Control, State and Local Water Control), Assistance on Destruction Negotiation & Product Removal of Pesticide/Drug /Biological Contaminated Product

Over 20 years of specialized knowledge in food and beverage industry/Crisis Management/Media experience

Unlimited Telephone access to independent and licensed Loss Control Consultants

© Copyright SRM® , Inc. and its licensors. All Rights Reserved.

This page is not intended to be a representation of coverage. See policy wording for details. All coverage

features are still subject to individual underwriting and certain coverage features may be restricted.

Powered by

Powered by